Hub,

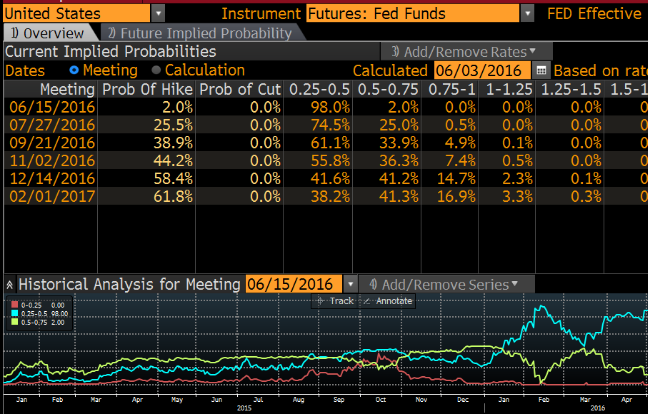

Las probabilidades de un hike en Julio son infra-ponderadas x los FFF, el lunes Yellen va a dejar claro q se pincha la burbuja para no terminar en un LEH con Bancos Centrales q han quemado ya sus balas (QE, ZIRP, NIRP).

En el cuadro de abajo ves lo q va a descontar SPY despues...

In a speech, Mester also weighed in to the debate about the role of monetary policy in heading off financial imbalances saying the Fed should only resort to using interest rates if other more precise tools fail.

"If our macro prudential tools proved to be inadequate and financial stability risks continued to grow, I believe monetary policy should be on the table as a possible defense," she said.

As the Fed approaches a potential rate hike as soon as this summer, one reason to act sooner than later is to head off any brewing instabilities in risky corners of financial markets such as commercial real estate, where high valuations have attracted some recent concern.

So far the Fed's approach has been to use financial regulations and supervision of banks and other firms - so-called macro prudential tools - to head off any emerging risks.

"Financial stability should not be added as a third objective for monetary policy," said Mester.

http://www.cnbc.com/2016/06/04/feds-mes ... eport.html