CANAYA escribió:no puede romper

APBR (ord) APBRA (pref) Petrobras Brasil

Re: APBR (ord) APBRA (pref) Petrobras Brasil

Vos si que rompes !!

Re: APBR (ord) APBRA (pref) Petrobras Brasil

no puede romper

Re: APBR (ord) APBRA (pref) Petrobras Brasil

Charlatanes Bajistas

Donde estan ??

Donde estan ??

-

Stiffmeister

- Mensajes: 1555

- Registrado: Mar Nov 03, 2015 4:05 pm

Re: APBR (ord) APBRA (pref) Petrobras Brasil

mie*** que paso

Re: APBR (ord) APBRA (pref) Petrobras Brasil

BMJ escribió:si...horrible de acuerdo al contexto

btg pactual nos hizo caso

Re: APBR (ord) APBRA (pref) Petrobras Brasil

BMJ escribió:si...horrible de acuerdo al contexto

tendría que estar arriba de los 6,3 ya

y sigue por acá

sigue bajista, pero cuando se de vuelta ya va a ser tarde para entrar

Re: APBR (ord) APBRA (pref) Petrobras Brasil

La liberación de los precios de los combustibles...no debería ser un driver alcista también?

Parece que no leen los diarios que no se enteran?....jajja

Parece que no leen los diarios que no se enteran?....jajja

Re: APBR (ord) APBRA (pref) Petrobras Brasil

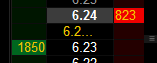

LA GUERRa esta en los 6,24

Re: APBR (ord) APBRA (pref) Petrobras Brasil

Hub escribió:muy mal petrobras hoy

posiblemente termine neutra

si...horrible de acuerdo al contexto

Re: APBR (ord) APBRA (pref) Petrobras Brasil

muy mal petrobras hoy

posiblemente termine neutra

posiblemente termine neutra

-

marcelo1975

- Mensajes: 3434

- Registrado: Lun Dic 31, 2012 8:00 pm

Re: APBR (ord) APBRA (pref) Petrobras Brasil

Buen día.

Respecto a la FED, en qué afectaría para mal? Gracias.

Respecto a la FED, en qué afectaría para mal? Gracias.

Re: APBR (ord) APBRA (pref) Petrobras Brasil

estan regalando la 42,4...esperen que pase los 2 pesitos...

Re: APBR (ord) APBRA (pref) Petrobras Brasil

Haciendo el 2do hombro el Ewz del HCH, bien

Re: APBR (ord) APBRA (pref) Petrobras Brasil

BMJ escribió:Maestro!! tanta confianza y autoestima no te niego que genera confianza....

si te acompaño hasta los 22 hay que festejar grande....jjejejej

Re: APBR (ord) APBRA (pref) Petrobras Brasil

neofito escribió:Precio objetivo 22 usd

Precio objetivo ésta semana 6.50

OIL en breve arriba de 51 usd antes de terminar la semana

No tienen ni idea como funciona la bolsa

Maestro!! tanta confianza y autoestima no te niego que genera confianza....

si te acompaño hasta los 22 hay que festejar grande....jjejejej

¿Quién está conectado?

Usuarios navegando por este Foro: Ahrefs [Bot], Amazon [Bot], Baidu [Spider], Bing [Bot], carlos_2681, ELViS_PRESLEY, escolazo21, Google [Bot], M07, Majestic-12 [Bot], notescribo, RICHI7777777, Semrush [Bot] y 1123 invitados